Settings

Before you start calculating, you need to adjust the following settings.

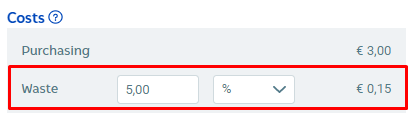

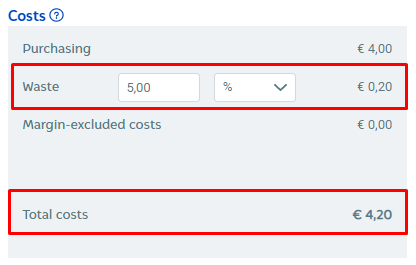

Waste

Some ingredients or semi-finished products are thrown away when preparing a dish, so fill in a percentage or fixed amount for wastage. The default entered here is 5%. So, if the purchasing cost is €3, the wastage added to that is €0.15. This allows you to factor in the costs of wastage in the sales price.

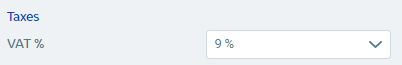

VAT %

Select the applicable VAT rate. Almost all foods are subject to the lower VAT rate of 9% in the Netherlands.

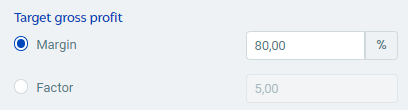

Margin (gross profit %)

For Margin, enter the target gross profit, and you will see that this determines the factor. If you enter a margin of 80%, that means 80% of the sales price (excluding VAT) is gross profit. The other 20% is the purchasing cost. For example: For a margin of 80%, the factor is 5 (5 x 20% = 100%). The system multiplies the total cost by 5.

Alternatively, you can also set the Factor instead. When you fill in this, you will see that this determines the margin.

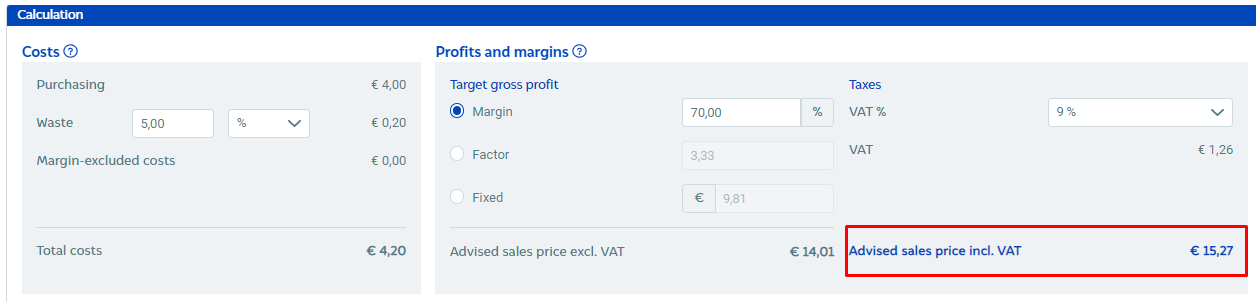

Calculation

The calculation works as follows:

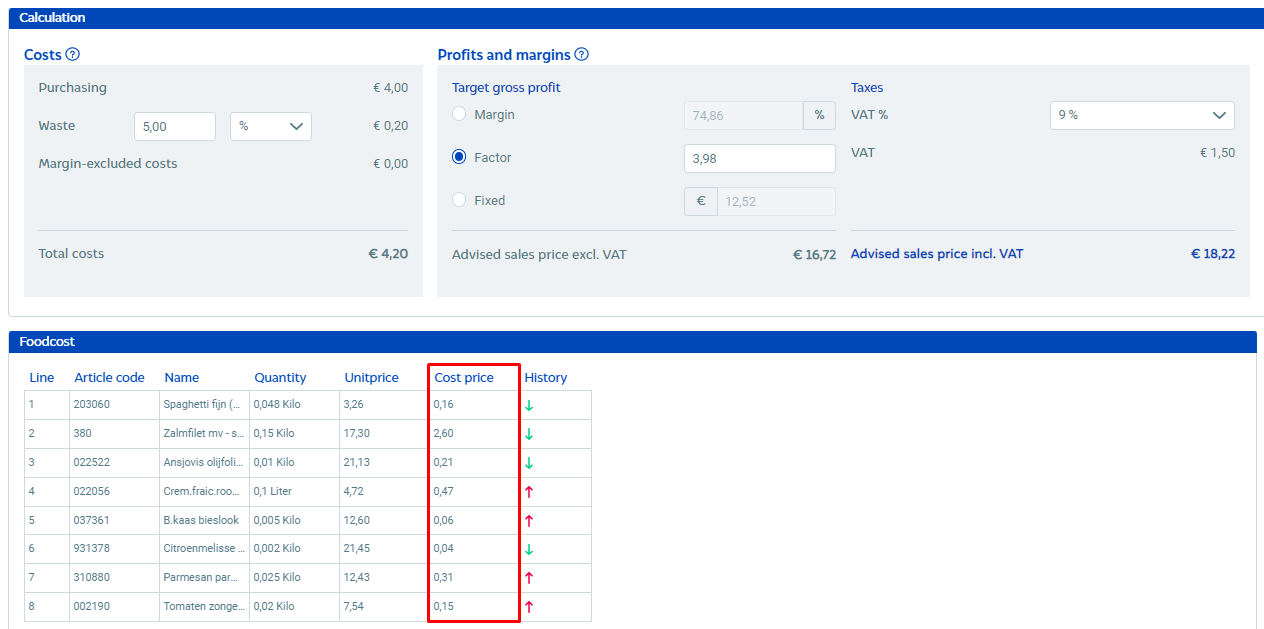

Purchasing cost

The first thing to look at is the purchasing cost. The individual cost prices per item (ingredients, semi-finished products and any underlying semi-finished products) are shown in the table at the bottom. The total purchasing cost is displayed at the top of the Costs table.

In this example, the purchasing cost is €4.

Waste

The wastage cost will be calculated automatically using the waste percentage that you filled in when you adjusted the settings. In this example, the waste cost is €0.20, so the total cost is €4.20.

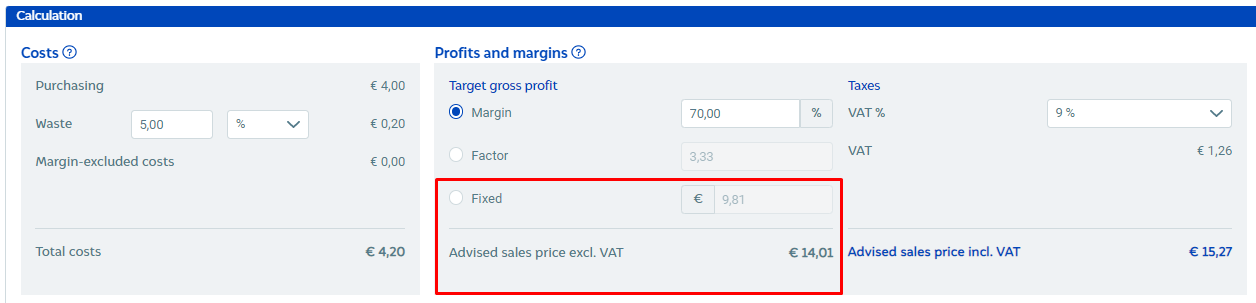

Gross profit

The gross profit is then calculated and added. In this example, the target gross profit percentage entered is 70%. The remaining 30% is the purchasing cost of €4.20.

Sales price excl. VAT (100%): €4.20 x 3.33 (not rounded) = €14.01.

Gross profit in euros (70%): €14.01 - €4.20 = €9.81.

Margin-excluded costs

These are the costs for things like disposables. These are added separately after calculating the gross profit percentage on the purchasing cost, including waste percentage. These costs are therefore included in your calculation, or rather recouped, but not included in the margin.

If you use disposables, please see the article Dishes – Calculations – Disposables.

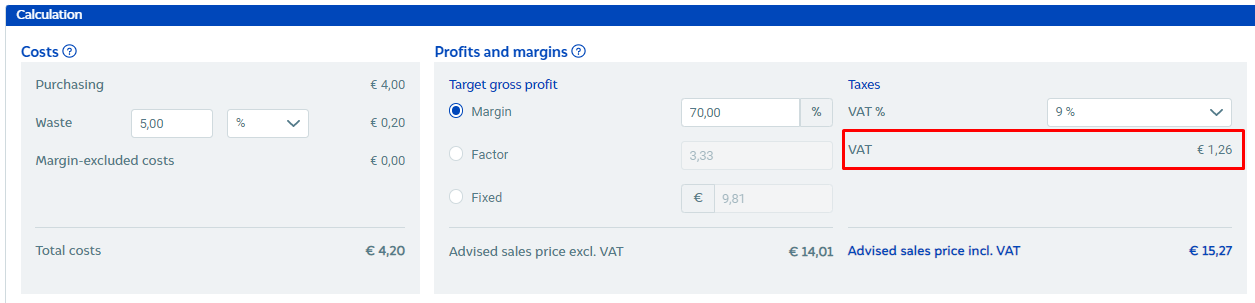

VAT

Lastly, the VAT is calculated. In this example, the VAT rate entered is 9%.

The sales price including VAT is therefore 109%: €14.01 x 1.09 = €15.27

VAT in euros: €15.27 - €14.01 = €1.26

Advised sales price incl. VAT

Based on the settings filled in and the target gross profit percentage, an advised sales price is calculated that includes VAT.

In this example, the advised sales price is €15.27.

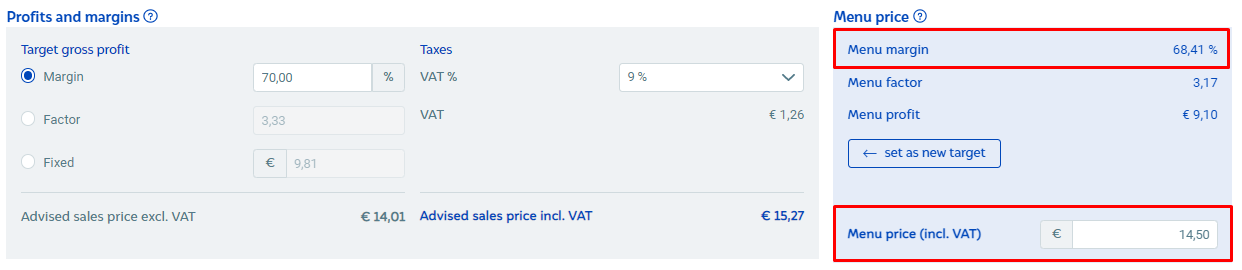

Menu price

The advised sales price incl. VAT is often not a nicely rounded number. Under Menu price, you can enter the price including VAT as you would like it to appear on the menu and see how it affects the actual gross profit margin.

In this example, the menu price selected is €14.50, which changes the margin to 68.41%.

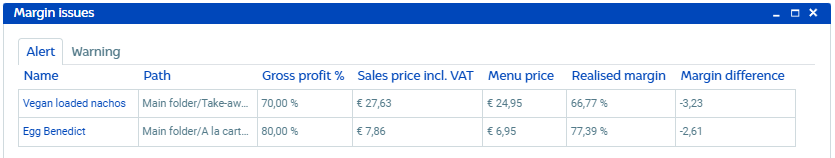

Margin issues – Aligning the menu price and sales price incl. VAT

Horeko also helps you to keep an eye on fluctuations in margins. On the Dashboard, you will find the Margin issues widget.

This shows the dishes whose margin has fallen by 2% compared with the target gross profit, i.e. the percentage entered in your calculation settings.

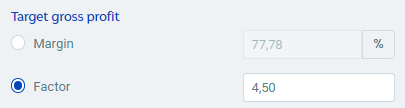

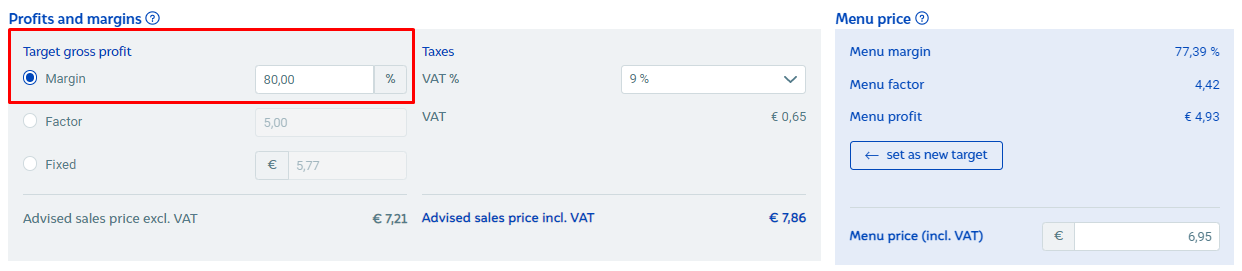

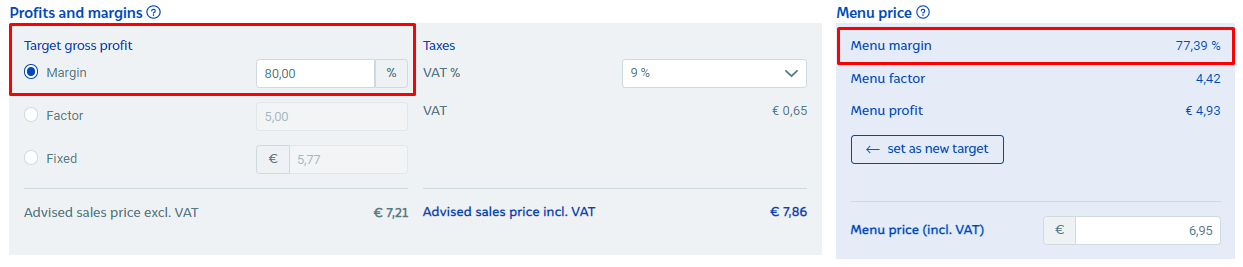

We recommend you bear the following in mind. If you enter a target gross profit percentage of 80% and set a menu price with a gross profit margin of 77.39%, the difference between 80% and 77.39% is already greater than the margin threshold of 2% from the outset. So, this dish is immediately highlighted in the Margin issues widget.

Because you actively entered a menu price with a margin of 77.39%, you probably don’t want to get a warning until the margin decreases by 2% compared with the 77.39%.

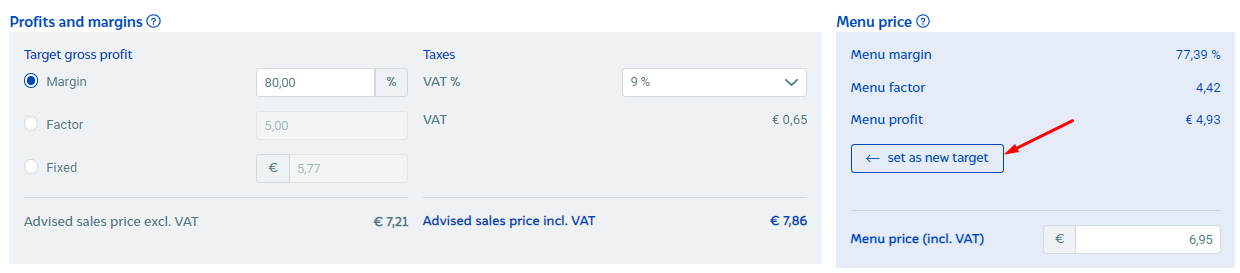

In the calculation, you can align the sales price incl. VAT equal with the entered menu price. This means you will not receive a warning until the margin drops 2% below the 77.39%. Click the Set as new target button.

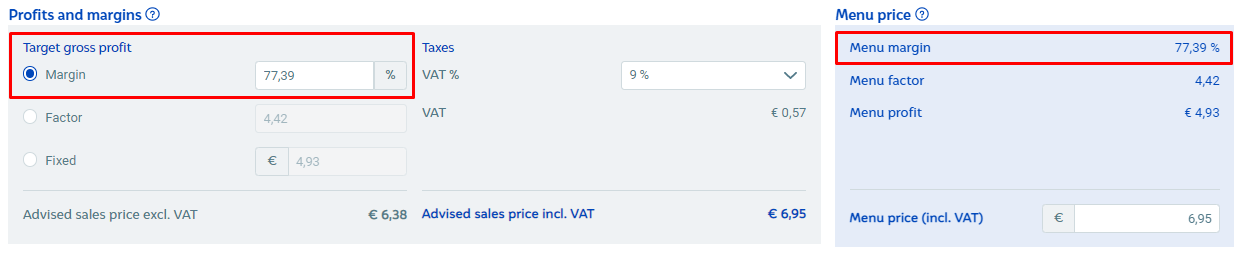

Both the menu margin and the target gross profit margin are now set to 77.39%.

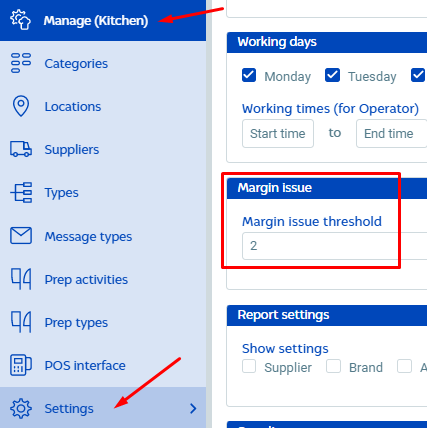

To change the margin issue threshold, which is set by default to 2%: Go to Manage (Kitchen) -> Settings -> Margin issues.

Labour costs

When viewing a dish under the General tab, go to the Information section, and you will see that you can enter a number of hours and/or minutes for Labour (Kitchen) and Labour (Other).

To set the default labour costs, go to Manage (Kitchen) -> Settings. Under the Default labour hourly rates section, you can enter the average costs (€) per hour.

Back under the Financial tab of a dish, you can calculate the labour costs for that dish. The labour costs are listed separately; these are not included in the menu price calculation, because labour costs are variable. A head chef’s time typically costs more than a trainee’s. It is also true that the preparation time for a dish is not the actual amount of time a chef has spent on the dish. If it takes 30 minutes to make a soup, the chef is likely to do all sorts of other things in those 30 minutes while waiting for it to cook. For that reason, Horeko does not include the preparation costs as a standard measure, but you can still take them into account when determining the gross profit margin. (Labour costs are paid out of that gross profit margin.)

Here’s an example of how 100% of a sales price can be broken down:

-30% purchasing (food cost)

-30% labour costs

-30% overhead costs

-5 to 10% net profit

Horeko focuses on food cost.